Free Zones Law and its Reforms

(Decree 65-89)

Features

The purpose of this Law is to encourage and regulate the establishment of Free Trade Zones in the country, which promote national development through the activities carried out therein, particularly in actions aimed at strengthening foreign trade, employment generation and technology transfer.

Limited to two sectors

a) Producers of industrial goods: production, transformation, assembly, assembly and processing of goods, with the purpose of providing them with other characteristics, uses or functions, different from those of their original or consumed materials or components, or to technological research and development.

b) Services: When they are engaged in the rendering of services, including commercial activities, related to international trade.

Authorizes: Directorate of Trade and Investment Services of the Ministry of Economy (MINECO).

Authorization time: 10 working days from the moment the documentation is submitted to MINECO.

Address: 8 Avenue 10-43, zone 1, Guatemala City.

Phone: +502 2412-0200

FREE ZONE QUALIFICATION PROCESS

1. Submit a request to DISERCOMI, which issues an opinion within a period of no more than 30 days.

2. With the previous opinion, the Mineco resolves the origin of the request, in a term no longer than 15 days.

3. Once the administering entity is authorized, it may process user applications. See user requirements.

INCENTIVES

– Total exoneration of taxes, customs duties and charges applicable to the importation of machinery, equipment, tools and materials destined exclusively to the construction of infrastructure, buildings and facilities used for the development of the free zone.

– Total exoneration from Income Tax (ISR) on income derived exclusively from its activity as an administrative entity, for a period of 10 years.

– Exoneration of the Stamp and Stamped Paper Tax levied on the documents by means of which the ownership of real estate destined to the development and expansion and the ownership of real estate to users is transferred in favor of the administrative entity.

– Exemption from the Single Tax on Real Estate, for a period of 5 years.

– VAT exemption on the acquisition of locally produced inputs to be incorporated into the final product and services.

Other benefits*:

- Warehouses of different sizes

- Wastewater treatment

- Water

- Electricity and internet

- Security and surveillance 24 hours a day Streets suitable for international business activity

* These benefits may vary according to what each free trade zone offers.

REQUIREMENTS

1. Request from the user entity (download). DISERCOM issues an opinion within 30 days.

2. With the previous opinion, Mineco resolves whether or not the user’s operation request is valid or not within a period not exceeding 15 days.

The application must be accompanied by:

- -Simple copy of the Resolution of authorization of installation and operation of the user.

- -Simple copy of the testimony in case of legal entity.

- -Simple copy of the appointment of the legal representative.

- -Simple copy of the Personal Identification Document (DPI) of the legal representative.

- -Proof of the Unified Tax Registry. Simple copy of the Trade Patent of the Company and Society.

- -Copy of the last IGSS3 dues payment receipt. Solvency of not having pending fines in the IGSS.

- -Tax solvency issued by SAT4. Certification of Shareholders Registry.

- -Sworn statement before a Notary Public stating that the company has not been sanctioned with revocation of the benefits conferred by the Free Zones Law, is not operating as a beneficiary of the Free Zone of Santo Tomás de Castilla and is not enjoying the tax incentives of other laws in force.

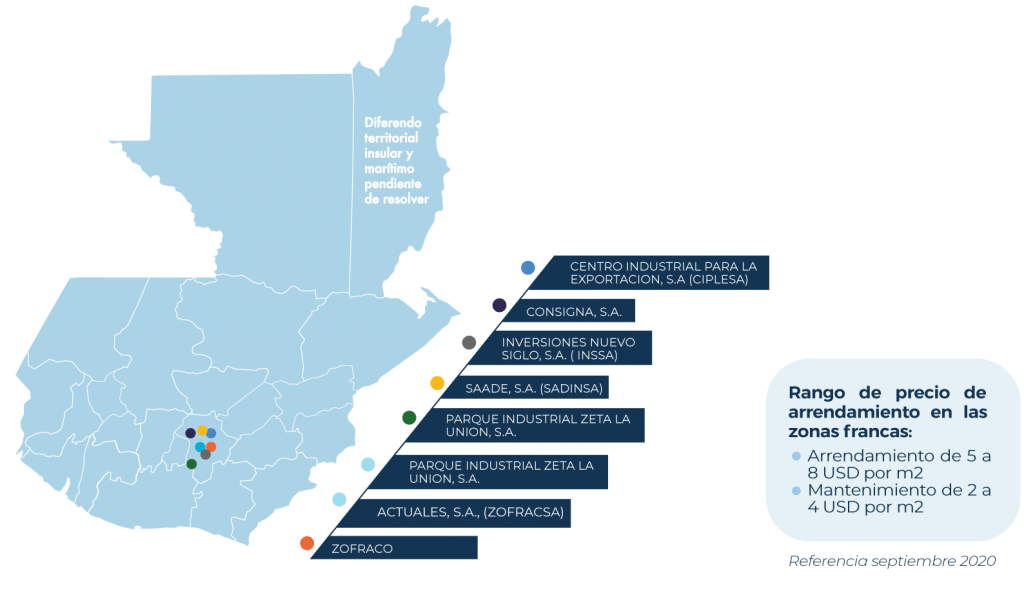

Free zones: